I got a few emails from REIbrain subscribers last week and over the weekend asking to review the Real Estate Mogul Preston Ely program that came out last week. While I’ll do my candid review below… I honestly wanted to address the “Hedge fund” market first in this article to give you my honest take on it.

The last few months I’ve seen tons of news articles flying around talking about hedge funds jumping into the single family house rental market. Firms like Blackstone diving in and buying up bunches of single family properties at discounts (many times direct from banks in bulk deals)… then renting them out for their yield.

Hedge funds are seeing the opportunity that the low single family houses poses right now… and they predict they’ll make much stronger returns with single family houses (on the rents and on the exit in a few years) than in the stock market. Are they right… I think so.

But also, anytime you see so much movement in one direction for investments… it also creates other problems and opportunities.

Is It A Bad Thing For Smaller Real Estate Investors That Hedge Funds Are Now Competing Against You?

One of the big conversations I’ve seen going around lately is that hedge funds are going to put the “mom and pop investor out of business”… and this is both true and false at the same time.

It’s true in that yes, many of the deals that you’ve been competing for… are now being gobbled up by hedge funds who have almost unlimited buying power… and will even purposefully overpay for properties because all their looking at is yield. So, that’ll price you out of many of the deals that you’ve made your bread and butter.

So, if you’re competing for the same types of houses that firms like Blackstone are… yes, you’re going to have a tough time.

But, I see it as an opportunity for savvy real estate investors as well.

Why?

Simple…

Hedge Funds Have A Massive Weakness…

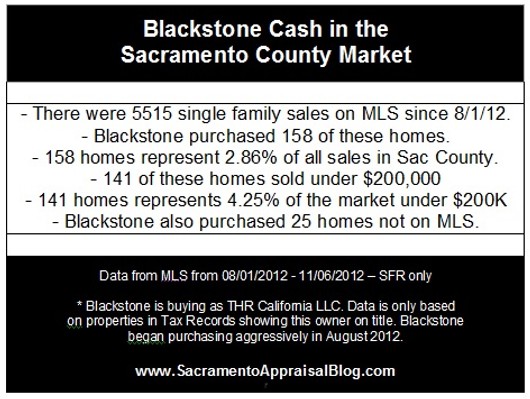

As you can see in the stats above, Blackstone started aggressively buying in Sacramento in 2012… and out of 158 total houses bought… 25 were NOT on the MLS. Read below why this can help you…

… and that weakness is that they are most of the time not local. They don’t know the players in the market as well as you may… they might not have the relationships for the “off MLS” deals that you do… and they have their sights on a pretty narrow set of property specs.

So, if they’re buying up all of the 2/2 and 3/2 properties in XYZ neighborhoods at prices of only 85% of value (when you need to close on 70% or less for it to be a good deal)… or going through big banks and buying up all of their inventory… that leaves open the tons of deals still out there that are “off MLS” deals.

Ones where a homeowner is in foreclosure or just needs to sell and your marketing gets them to call you.

Or the homeowner “Googles” for a solution to “Sell my house fast” and finds your website…

… or you’ve carved out a nice niche in HUD homes that you’re buying… putting a couple bucks into and renting them out for a great cashflow.

It’s kind of like football… if the defense shuts down your running game… you just switch it up and focus on the pass a bit. Business is the same way. You have to always adapt to the market and find the hidden opportunities where they lay.

Weaknesses Aside… Why May It Be Good For A Hedge Fund To Buy In My Market?

Simple. They’re “overpaying” for houses in many markets… and helping raise home values again. So you can take this one of two ways… that you should find where hedge funds are wanting to buy… and buy around them (in hopes of home values going up over the next few years… yes, this is speculation to an extent… but still buy right and buy for cashflow / yield… don’t bank on appreciation).

Here’s a great 3 minute Fox News story on this… check it out… then read on below:

So it’s also a double edged sword… first off… these houses the hedge funds are buying are vacant… which them putting tenants in them right there helps raise the moral and value of the neighborhoods. But at the same time… that could cause neighborhoods to turn from mostly owner occupied to rental dominated (which drags down house prices a bit).

BUT… the big but here is… hedge funds aren’t in the business of owning houses for 30+ years. They want yield and returns… and they won’t hold onto these houses forever. They see a current opportunity in the market to get a valuable asset at discount rates… get someone to pay the mortgage on those assets… and they likely plan to sell those houses once the market picks back up, values go up, and they can sell for a solid profit (to move those profits into other things that at that time show opportunity). You get the idea.

You have to think long-term and strategically about this whole “hedge fund” situation.

Can it be bad for your business? Yep. If you don’t do anything.

Can it good for your business? Yep. If you shift your strategy a bit and go where the hedge funds aren’t going.

So, What Should You Do?

There’s no right or wrong answer to this discussion.

If you’re a rental property owner and you want to buy more properties and hold them for rental… you’re now competing directly against someone with a heck of a lot more money than you… who will pay more for the same house than you could.

You need to look where hedge funds aren’t.

Where? Here’s a place to start (great resource that I’m actually a part of) to get that edge <<

Next, really cultivate those local relationships (something the hedge funds don’t do well)… and look for properties off the MLS that they don’t see.

When it comes to competing with a hedge fund… don’t try to directly compete with them on the same properties. You’ll lose almost every time. Instead switch it up a bit and buy around them and let their overpaying increase the value of your own properties. If hedge funds want properties that are lets say 10 years or newer… you should be looking for ones that are 11 years or older… to avoid the head to head clash. If they’re focusing on single family (which many are)… that means there’s probably an opportunity for multi-family out there that has less competition.

If you’re a wholesaler and you’re seeing your deals get snapped up by hedge funds… you can do what I talk about above and work around them (if they’re focusing on MLS… you should focus where they’re not looking and cultivate those relationships that are sending you the good deals right now). Or, you can start to work WITH the hedge funds (like this webinar tomorrow, Tuesday, will talk about)… and find the off MLS deals at the yields that they’re looking for (all easy stuff to calculate if you know how), strike up a relationship with the hedge funds local rep… and see if there’s an opportunity to send them a consistent stream of great deals that you can make a wholesale fee from. Again, this webinar tomorrow (Tuesday) will talk more about this.

It’s all about looking at the situation… finding out how hedge funds work and their motives… and outsmarting them… NOT competing against them.

If you’re a wholesaler or “buy and hold” investor… you’ll want to do your research on this new wave of hedge funds coming into the single family rental market… and formulate a plan on how you’re going to outsmart their strategies (i.e. – how you can leverage what they’re doing and how you can work around them… not against them). If that’s you… here’s a training webinar we came across last week that is running again Tuesday and Wednesday that you’ll want to be on. Register for it free below:

>> Join The “Hedge Fund Outsmart” Webinar This Week (Tuesday and Wednesday) To See How Savvy Investors Should Adapt To Outsmart The Hedge Funds In Your Market – Click Here To Register (It’s a free training put on) <<

NOTE: We were actually invited to contribute our knowledge and resources to the Real Estate Mogul community and we fully back and endorse it as a GREAT resource for real estate investors looking to adapt to this new hedge fund push for buying single family housing. Check out the webinar this week to learn how to adapt to this hedge fund trend. If you feel that joining the Real Estate Mogul community is right for you to navigate this market… we may earn a commission if you purchase through the links on this website. We only endorse programs we fully believe in and stand behind… this is one of them. We feel its our duty to help guide our readers to the best resources that we feel can help many investors get an edge in the market.

I do not think they are investing for the cash flow, but to bid up prices and dump when they can no longer control them. They’ve driven the rents up so high where I live that people are moving away, but many with deeper pockets are moving in. It is not a sustainable situation.